Private Equity

Temporary equity commitment with a high rate of return

Key facts

- Equity capital contribution for real estate development projects (retail property)

- Capital commitment for approx. 12-18 months

- Rate of return between 8 % and 15 % p.a. depending on project structure

Our Approach

Investments are made at the last phase of real estate development projects.

At this stage, developers and contractors oftentimes lack adequate liquidity in order to realise

the planned construction. Up-front costs for planning and site acquisition are usually due over

the first two years of a project and frequently deplete the parties’ funds.

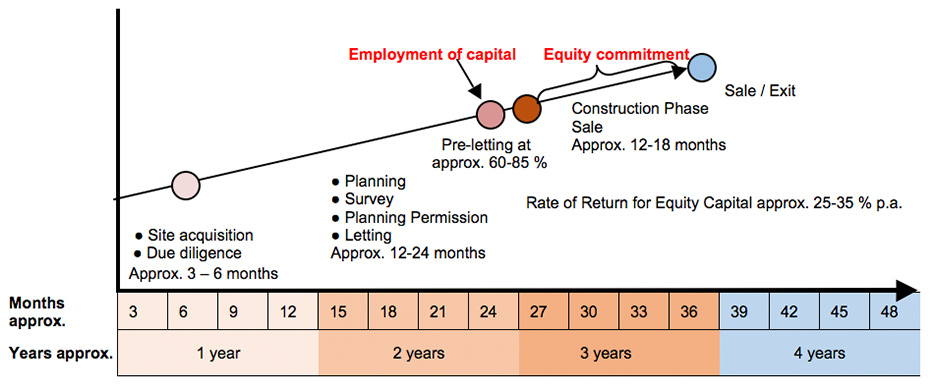

From site acquisition to exit – a visualisation of our investment strategy

We enter the project at the above shown interface between the granting of planning permission

and the beginning of the construction phase (approx. 24 months into the project).

Free and unproductive equity capital is invested into high yielding development opportunities within

a set timeframe of commonly 12 – 18 months. Due to a short investment period and favourable

interest rates on debt capital, this strategy offers an attractive capital rate of return of approximately

25% to more than 30% p.a.

Examples of previously realised investment schemes can be found in Creating Sustainable Values.